After Airtel launched India’s first payments bank on 12th Jan, The department of Indian Post followed it’s footsteps quckly by launching India Post Payments Bank . Unlike Airtel IPPB is 100% Indian Government owned public limited company under the department of the posts which aims to open around 650 new branches in postal district headquarters . IPPB launched it’s pilot operations in Raipur and Ranchi on experimental basis . This made it second in the payment bank entrants in India . APB and IPPB differs a bit when it comes to the offerings and services provided to the customers .

However let’s understand what a payment bank is for those who are new to the term .

A Payment Bank

| CAN | CANNOT |

| Accept Deposits | Cannot lend money |

| Maximum Account Limit Rs. 1,00,000 per customer | Cannot take NRI deposits |

| Can issue ATM and Debit Cards | Cannot issue credit cards |

| Can set up branches, ATMs, Business Correspondents | Cannot set NBFC subsidiary |

| Can accept money for transaction (upto 1lakh) | |

| Distribute mutual funds, pensions products , Insurances |

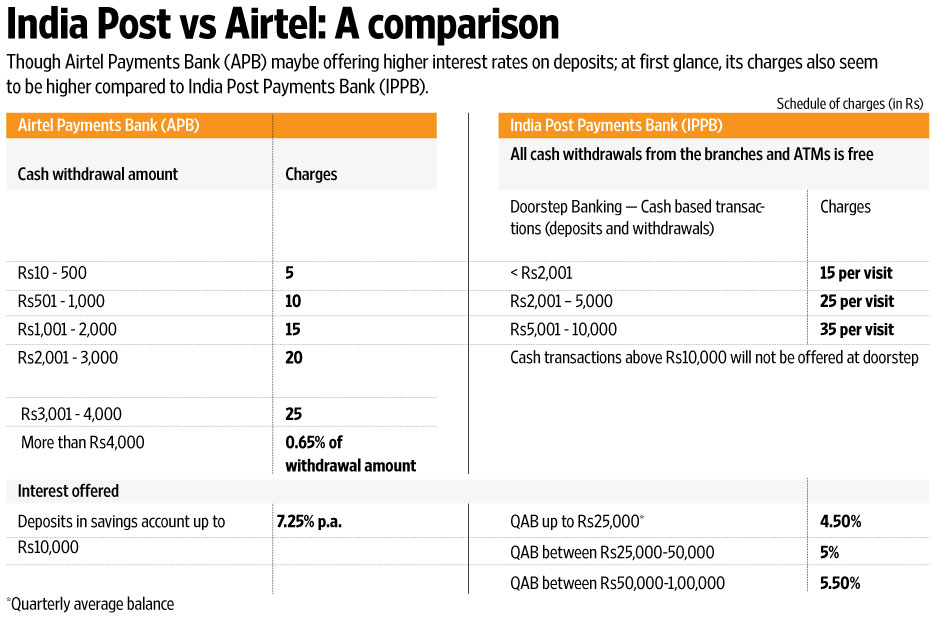

With Airtel already offering 7.5% interest rates , it would a tough job for IPPB to stack up against APB . Let’s understand the charges levied and interest rates offered by both the payments banks for rendering different services including deposits and withdrawals .

1. Types of Bank Accounts

| Airtel Payments Bank | Indian Postal Payments Bank |

| No Classification like IPPB , mobile number will serve as bank account ( airtel as wll other mobile services | Safal : Regular Bank Account , maximum account balance limit 1 lakh , 100 rupee maintance fee from 2nd year |

| Saral : Basic savings deposit account , maximum account balance limit Rs. 50,000 | |

| Sugam : Basic savings deposit account , maximum account balance limit Rs. 1 lakh |

2. Interest on Bank Accounts

| Airtel Payments Bank | Indian Postal Payments Bank |

| Interests are to be paid per annum basis | Interests are to be paid on quaterly basis against per annum |

| Offers 7.5% interest rate on savings account along with personal accidental insurance of Rs 100,000 | If QAB(quarterly average balance) is less than Rs. 25,000 the interest rate is 4.5% per annum |

| If QAB is above Rs 25,000 and below Rs 50,000 the interest is 5% per annum | |

| If QAB is above Rs 50,000 the interest is 5.5% per annum |

3. Debit Cards

| Airtel Payments Bank | Indian Postal Payments Bank |

| Doesn’t offer physical debit card | Offers phyisical debit card with every account |

| Virtual Master Card to be provided |

4. Fund Transfers

| Airtel Payments Bank | Indian Postal Payments Bank |

| Airtel will charge a maximum of 0.65% for a cash withdrawal from it’s customers | Domestic remittance services will be provided through NEFT, IMPS, Aadhaar-Enabled Payment System (AEPS), UPI and *99# (USSD banking). |

| Transactions on the AEPS are limited to Rs 10,000 but the accounts need to be linked to Aadhaar and can happen on micro ATMs only. | |

| Transactions on the UPI have a limit of Rs 1 lakh and money can be transferred to any bank account. | |

| USSD transactions are limited to Rs 5,000 per transaction |

Other services provided by IPPB that are not yet available with APB

Offers doorstep banking services to the customers at a minimum fee . Below are the door step services offered by Indian Postal Payment Banks

- Cash Withdrawl

- Cash Deposit

- Adhar to Adhar fund transfer

- Balance enquiry

- IPPB will also offer current accounts and access to third party financial services like insurance, mutual funds, pension, credit products, and forex at a later stage .

Going by the offerings and services it won’t be easy to say which payment bank will get the lead as Paytm is still to enter to market only to make the competition tougher .