What is being described as the boldest move in the history of Indian economy to curb the evil menaces of black money, the announcement of demonetisation by Prime Minister Mr. Modi has taken everybody by storm . The decision to demonetise Rs 500 & 1000 notes and only currency values with denomination of Rs 100 and below being accepted, people are resorting more towards online banking & online payments to manage the expenses of day to day.

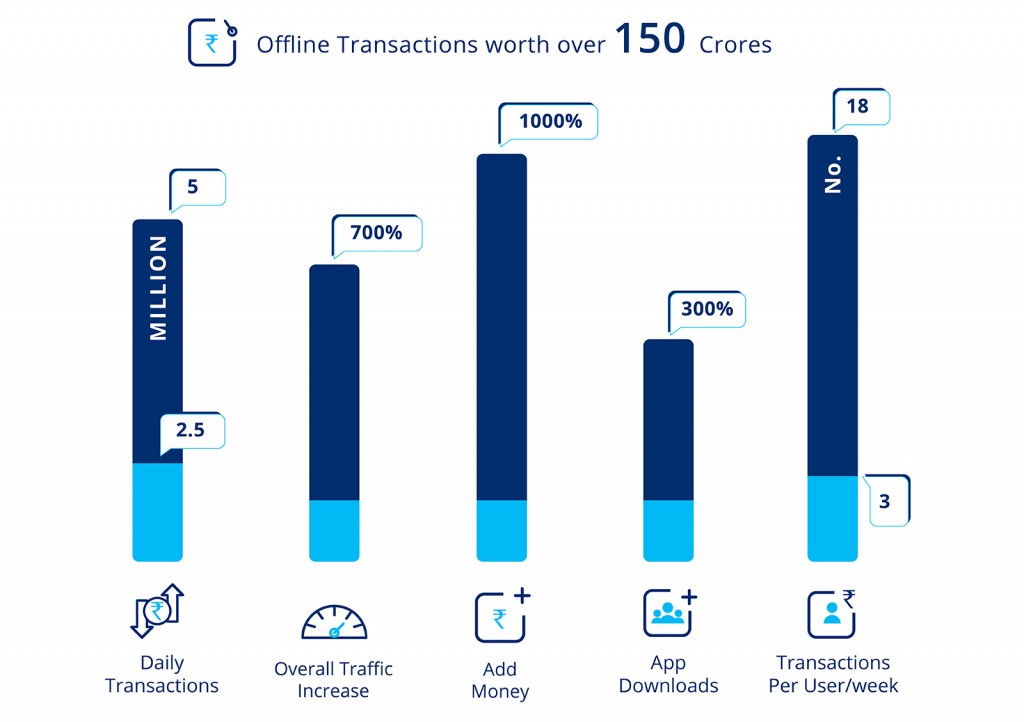

With no cash to spend, ATMs running out of money, E-wallets are the one who are flattening bigger and bigger . The gala has begun for digital wallets with the announcement of demonetisation , many of them witnessing massive rise in the number of downloads . Wallets like Paytm & Ola Money has grown by 300% & 1500% respectively . The average number of transactions has grown from 3 to 18.

Chart below depicts the growth rate of Paytm

Paytm has grown from 50 million users to 150 million within a span of 10 days. Similar growth trend has been seen in other major digital wallets like Freecharge, Mobikwik , thus is the effect of demonetisation .

Comparative study of major E-wallets in India.

The table below would help you to understand about the major E-wallets available below in India, their usages , benefits & advantages.

| E- Wallets | Installs | Number of Retailers | Transaction Charges (Before Demonitisation) | Transaction Charges (after demonitisation) | Accepted Offline | Store Limit Without KYC (30 Days ) | Store Limit With KYC (30 Days) | Virtual Card Facility |

| Paytm | 100+ million | 10+ lakh * | 4% | 0 % | Yes | INR 25000 | INR 1 lakh | No |

| Freecharge | 10+ million | 30000 * | 2.50% | 0 % | Yes | INR 25000 | INR 1 lakh | Yes |

| Mobikwik | 10+ million | 50000 * | 3% | 0 % | Yes | INR 10000 | INR 1 lakh | No |

| Oxigen Wallet | 5+ million | 19000 * | 3 % | 0% | Yes | INR 20000 | INR 1 lakh | Yes |

| Airtel Money | 1+ million | n/a | n/a | 0 % | No | INR 25000 | n/a | No |

Mobile wallet providers are now becoming kind of mini banks. It won’t be a surprise if they get their banking license (payment banks) and walk on the lines of Airtel and Paytm . The financial institutions have realised the potential of mobile wallets that is why each of them is coming with their own wallets.

E-Wallets from Indian Banks:

| Banks | Wallets | Features |

| SBI | SBI Buddy | Available in 13 languages, Send and recieve money, bill payments, shopping , KYC linked wallet up gradation for SBI customers |

| ICICI | ICICI Pocket | Visa Powered Card, Used for Shopping, Bill Payments, Money Transfer , also come with physical shopping card to be used on websites and retail stores |

| HDFC | PayzApp | Smart Buy discounts ,send money, bill payment, recharge, online shopping |

Along with E-wallets , another concept which is trending is Virtual Cards. Virtual also known as Electronic Card or e-Card, is a limit Debit Card created for eCommerce transactions. It minimises your dependency on primary cards and provides an easy and secure way of transacting online without providing the Primary Card/Account information to the merchant.

Banks Providing Virtual Cards :

| Banks | Virtual Cards (Credit & Debit) |

| SBI | SBI Virtual |

| HDFC | HDFC Netsafe |

Key Features of Virtual Cards:

- Security

- Highly Flexible

- No transaction charges

- Can be used at any merchant accepting MasterCards / Visa Cards

While country fighting hard to come in terms with effects of demonetisation and cash crunch , the e-wallet companies have gone on a overdrive to woo both customers as well as merchants . Most of them has brought down their transaction fee they charge from the customers to as low as zero percent for the time being .